If you’re aged 55 or over and have a defined benefit (final salary) pension that you haven’t yet started taking an income from, you may be able to explore alternative options. Options that could be available outside of the scheme through a pension transfer.

There are risks associated with transferring, it isn’t right for everybody and you can’t change your mind once it’s complete. But transferring can open up the choices you have over when and how to take your pension, and it might allow you to access more tax-free cash.

There are lots of things to consider when thinking about transferring out of a final salary pension, and that’s why the Government made it a legal requirement to take advice if the value of your transfer is £30,000 or more.

With our pension advice service we’ll:

- help you to understand the benefits your final salary pension provides

- explain the options available outside of final salary pension schemes, which would be available to you through a pension transfer

- consider other savings and investments you might have and your overall financial needs and goals

- advise you as to which path is best for you and your circumstances

- take care of any paperwork, if required

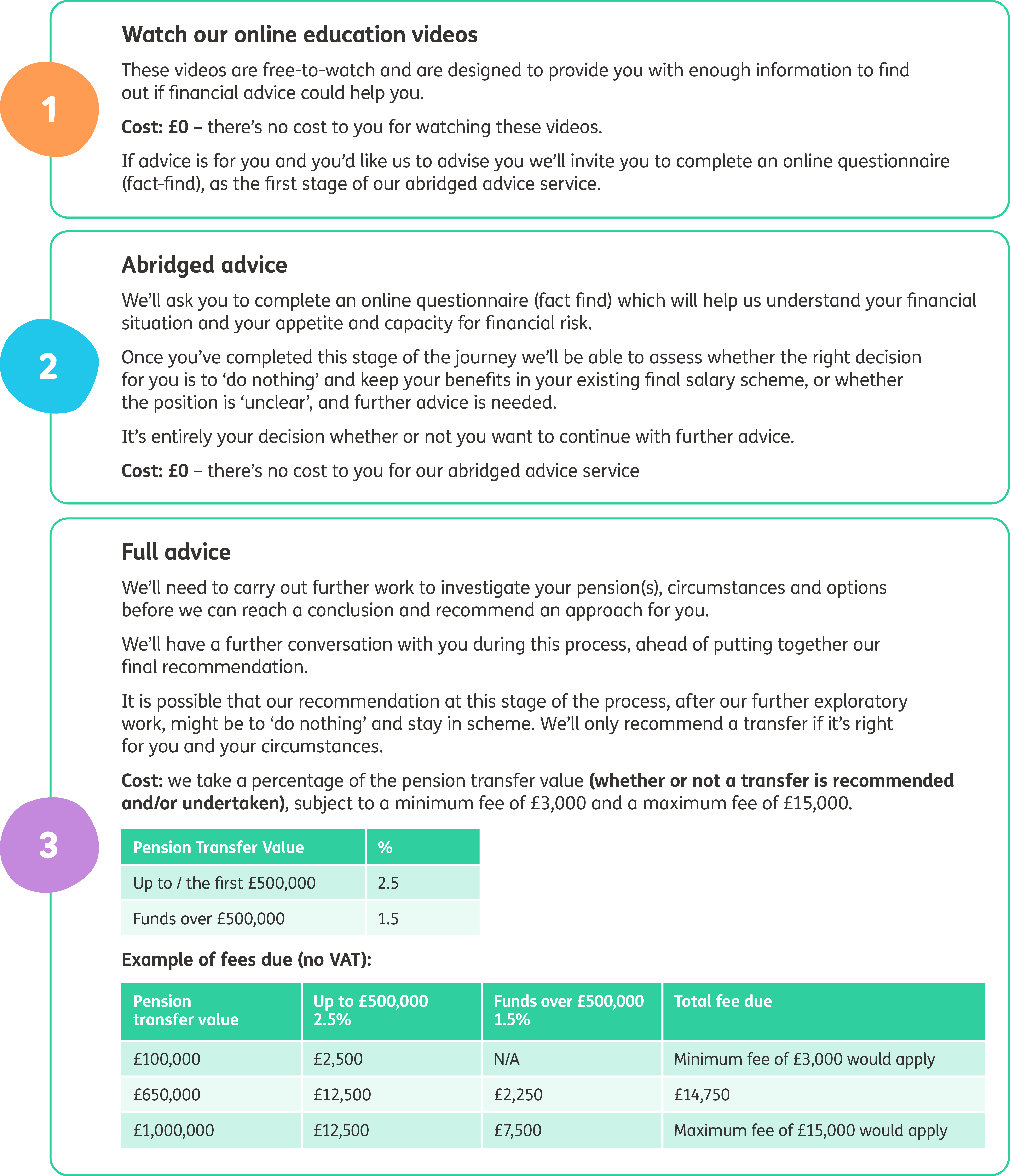

Our service and costs

![]() Our focus is on ensuring the right outcome for you and your specific circumstances

Our focus is on ensuring the right outcome for you and your specific circumstances

![]() We cater for all levels of pensions and financial knowledge. We make the complicated simple

We cater for all levels of pensions and financial knowledge. We make the complicated simple

![]() We’re happy to provide advice on any size of pension pot

We’re happy to provide advice on any size of pension pot

![]() We’re specialists in this area and have been providing advice on pension transfers for over 10 years

We’re specialists in this area and have been providing advice on pension transfers for over 10 years

Contact us

You might be ready to understand your options and take advice. Or you might have questions and want to chat to one of our team. Either way please do give us a call or send us an email.

Testimonials

Find out what others have said about us here.

Call

0800 031 5788, Monday to Friday between 9am and 5pm

You can email us at dbadvice@hubpc.co.uk